17th April 2024 CPI / Stats NZ

17th April 2024 CPI / Stats NZAnnual inflation has eased to its lowest level in nearly three years, according to the latest Consumer Price Index, which was up 0.6% in the March quarter, putting annual inflation at 4%.

4th April 2024 Employment / Stats NZ

4th April 2024 Employment / Stats NZFilled jobs in accommodation and food services increased by 2.8% in February 2024 compared with the same month last year, according to Stats NZ’s latest employment indicators.

15th March 2024 CPI / Stats NZ

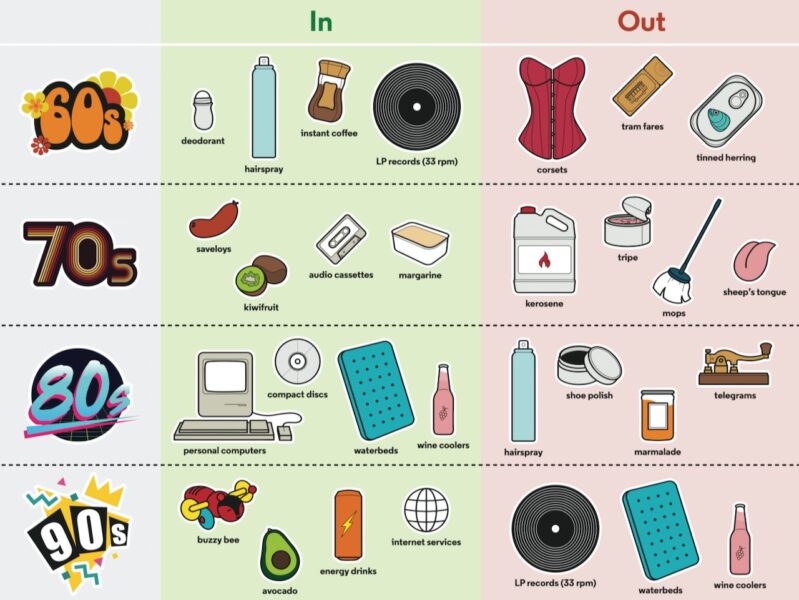

15th March 2024 CPI / Stats NZThe consumers price index (CPI) basket of goods and services used to measure inflation will be updated in April 2025, says Stats NZ.

13th March 2024 Hospitality / Stats NZ

13th March 2024 Hospitality / Stats NZConsumer spending in hospitality was $1.27bn in February 2024, according to Stats NZ’s latest electronic card transaction data.

27th February 2024 Alcohol / Stats NZ

27th February 2024 Alcohol / Stats NZAlcohol available for consumption in New Zealand decreased to 477 million litres in the year ended December 2023, a fall of 4.3% from 2022, according to statistics released by Stats NZ today.

18th January 2024 FPI / Stats NZ

18th January 2024 FPI / Stats NZAnnual food price growth in December was the lowest it has been in two years, but still rose close to 5% thanks to more expensive restaurant meals and takeaways

17th January 2024 Spend / Stats NZ

17th January 2024 Spend / Stats NZSpending levels fell by 2% in December, according to Stats NZ, capping off what was a tough year for many retailers with spending levels flat for the duration of 2023.

12th December 2023 Spending / Stats NZ

12th December 2023 Spending / Stats NZSpending on consumables and hospitality both increased in November 2023, compared to the same month last year, according to Stats NZ’s latest electronic card transaction data.

6th December 2023 Agriculture / Stats NZ

6th December 2023 Agriculture / Stats NZCattle numbers fell in the year to June 2023 but the amount of wheat and barley area harvested increased, according to Stats NZ’s latest agricultural production statistics.

4th December 2023 Exports / Stats NZ

4th December 2023 Exports / Stats NZNew Zealand exported $15bn worth of goods in the September 2023 quarter, down 14% compared to the same period a year earlier.

28th November 2023 Employment / Stats NZ

28th November 2023 Employment / Stats NZThe number of filled jobs in accommodation and food services rose by 5.1% in October 2023, compared to the same month last year, according to Stats NZ.

21st November 2023 Exports / Stats NZ

21st November 2023 Exports / Stats NZMilk powder, butter, and cheese led goods exports down $552m or 9.3% to $5.4bn in October 2023 compared to the same month last year, according to Stats NZ’s overseas merchandise trade statistics.

14th November 2023 FPI / Stats NZ

14th November 2023 FPI / Stats NZThe increase in annual and monthly food prices continues to slow, with the latter coming in negative for the second month in a row, according to Stats NZ.

20th October 2023 Prices / Stats NZ

20th October 2023 Prices / Stats NZStats NZ will provide more in-depth monthly inflation data on categories such as alcoholic beverages, fuel and travel.

25th September 2023 Exports / Stats NZ

25th September 2023 Exports / Stats NZGoods exports fell $296m or 5.6% in August 2023 to $5bn, compared with August 2022 with meat and dairy behind the drop.

27th July 2023 Stats NZ

27th July 2023 Stats NZThe cost of living for the average household increased by 7.2% in the 12 months to June 2023, according to Stats NZ.

3rd July 2023 Cheese / Stats NZ

3rd July 2023 Cheese / Stats NZCheese exports rose $763m or 35% in the 12 months to May 2023, compared with the previous year reaching $3bn, according to Stats NZ.

29th June 2023 Employment / Stats NZ

29th June 2023 Employment / Stats NZThe number of filled jobs rose 0.2% in May compared with a year ago, according to the latest Stat NZ figures on employment indicators.

13th June 2023 Spend / Stats NZ

13th June 2023 Spend / Stats NZCard spending in the hospitality industry rose to $1.18bn in May 2023, up 7.6% compared with the same month last year, according to Stats NZ.

9th June 2023 Employment / Stats NZ

9th June 2023 Employment / Stats NZThe hospitality sector has led an increase in the number of filled jobs for the March 2023 quarter, according to Stats NZ.

24th May 2023 Spending / Stats NZ

24th May 2023 Spending / Stats NZThe total volume of actual retail sales fell 4.1% in the March 2023 quarter, compared with the March 2022 quarter, according to Stats NZ today.

23rd May 2023 Agriculture / Stats NZ

23rd May 2023 Agriculture / Stats NZThere are fewer dairy cattle, sheep, and deer in New Zealand’s paddocks, according to the final results of the five-yearly Agricultural Production Census 2022 from Stats NZ.

10th May 2023 Spend / Stats NZ

10th May 2023 Spend / Stats NZRetail sales continued to increase in April, with a 0.7% rise for the month, similar to last month, according to Stats NZ.

1st May 2023 Employment / Stats NZ

1st May 2023 Employment / Stats NZThe number of filled jobs in the accommodation and food services sector reached 18,101 in March 2023, up 12.9% on the same month last year, according to Stats NZ.

27th April 2023 Exports / Stats NZ

27th April 2023 Exports / Stats NZGoods exports rose $40m or 0.6% to $6.5bn in March, compared with the same month last year, led by a big jump in preparations of cereals, flour, starch, and milk including infant formula.

13th April 2023 Spend / Stats NZ

13th April 2023 Spend / Stats NZRetail card spending rose 0.7% in the March 2023 month compared with February 2023, when adjusted for seasonal effects, according to Stats NZ.

5th April 2023 Emissions / Stats NZ

5th April 2023 Emissions / Stats NZSeasonally adjusted greenhouse gas emissions fell by 696 kilotonnes in the September 2022 quarter, which equated to a 3.5% reduction compared to the same period a year earlier.

9th March 2023 Spend / Stats NZ

9th March 2023 Spend / Stats NZRetail card spending remained flat at $6.6bn in February 2023 – the same as January 2023, when adjusted for seasonal effects – according to Stats NZ.

6th March 2023 Exports / Stats NZ

6th March 2023 Exports / Stats NZGoods and services exports for the December 2022 quarter totalled $24.7bn, up from $20.5bn in the December 2021 quarter, according to Stats NZ’s quarterly international trade statistics.

27th February 2023 Alcohol / Stats NZ

27th February 2023 Alcohol / Stats NZNew data from StatsNZ show the rise and rise in the availability of spirits, and which beer ABVs are being pushed the most.

7th February 2023 Grains & Seeds / Stats NZ

7th February 2023 Grains & Seeds / Stats NZThe total value of New Zealand seed exports for the calendar year 2022 totalled $221m, down 9% on the previous year, according to data issued by Stats NZ this week.

1st February 2023 Employment / Stats NZ

1st February 2023 Employment / Stats NZThe unemployment rate rose ever slightly to 3.4% in the December quarter, according to the latest figures from Stats NZ.

18th January 2023 Spend / Stats NZ

18th January 2023 Spend / Stats NZRetail card spending fell $166m or 2.5% in December 2022 compared with November 2022, when adjusted for seasonal effects, according to Stats NZ said today.

9th December 2022 Spending / Stats NZ

9th December 2022 Spending / Stats NZSpending on hospitality had the largest increase, up $368m or 43.6%, compared with November last year.

5th December 2022 Exports / Stats NZ

5th December 2022 Exports / Stats NZTotal exports of goods and services for the September 2022 quarter increased to $22.2bn, up from $17.7bn in the September 2021 quarter, according to Stats NZ.

29th November 2022 Stats NZ

29th November 2022 Stats NZSubscribe now to enjoy unlimited access to Food Ticker, New Zealand’s new food and beverage industry trade daily. Thank you for visiting Food Ticker. Click here for our subscription packages. We MORE »

23rd November 2022 Exports / Stats NZ

23rd November 2022 Exports / Stats NZPrice increases for dairy has helped boost New Zealand’s export values for October according to the latest overseas merchandise trade report from Stats NZ.

13th October 2022 FPI / Stats NZ

13th October 2022 FPI / Stats NZThe increasing price of two-minute noodles was one of the drivers of a 7.7% annual rise in the grocery category in September.

6th September 2022 Emissions / Stats NZ

6th September 2022 Emissions / Stats NZAgriculture, forestry, and fishing accounted for 61% of total industry CO2-e emissions in 2021

29th August 2022 Hospitality / Stats NZ

29th August 2022 Hospitality / Stats NZThe easing of border restrictions has contributed to sales volume growth in the accommodation sector of almost $71.3m, an 11% rise between the March and June 2022 quarters, according to Stats NZ.

10th August 2022 Spend / Stats NZ

10th August 2022 Spend / Stats NZElectronic card spending in the hospitality industry reached $1.9bn during July 2022, up from almost $1.1bn in the preceding month of June, according to Stats NZ data.

21st July 2022 Emissions / Stats NZ

21st July 2022 Emissions / Stats NZAgriculture, forestry, and fishing greenhouse gas emissions fell by 86 kilotonnes, or 0.2%, to 43,875 kilotonnes for the year to December 2021, compared with the previous 12 months, according to data from Stats NZ.

14th June 2022 FPI / Stats NZ

14th June 2022 FPI / Stats NZFood price inflation is back to where it was in February – a decade long record at the time – as groceries push the index up.

27th May 2022 Emissions / Stats NZ

27th May 2022 Emissions / Stats NZNew Zealand’s primary sector contributed the most to the country’s total emissions in 2020, coming in at 55%, but it added the smallest amount to GDP at 6.5%, according to data from Stats NZ.

11th May 2022 FPI / Stats NZ

11th May 2022 FPI / Stats NZFruit a vegetable prices were up 18% in last month’s FPI, but the pan-produce organisation said this should ease.

11th May 2022 Hospitality / Stats NZ

11th May 2022 Hospitality / Stats NZStats NZ said that in actual terms, monthly card spending on hospitality continued to decrease, down $56m or 4.9% compared with April 2021.

28th February 2022 Stats NZ / Supermarkets

28th February 2022 Stats NZ / SupermarketsFood and beverage sales volumes rose 12% in the December quarter as businesses came out of lockdown.

25th February 2022 Data / Stats NZ

25th February 2022 Data / Stats NZConsumers are shifting from the middle ground and becoming more adventurous.

21st February 2022 Prices / Stats NZ

21st February 2022 Prices / Stats NZProducer input prices rose 1.1%, while producer output prices rose 1.4% in the December quarter, led by dairy and construction.

14th February 2022 FPI / Stats NZ

14th February 2022 FPI / Stats NZAnnual food prices rose in 5.9% with widespread increases seen in January.

14th February 2022 Spending / Stats NZ

14th February 2022 Spending / Stats NZCredit and debit card spending increased a seasonally adjusted 2.1% or $175m in January, compared with December, according to Stats NZ.

11th November 2021 FPI / Stats NZ

11th November 2021 FPI / Stats NZFood prices eased marginally in October however the annual growth rate was well-above the long-term average, says Stats NZ.

10th November 2021 Spend / Stats NZ

10th November 2021 Spend / Stats NZNew Zealanders spent 9.5% more on their credit and debit card in October 2021 than in September as Covid-19 alert levels eased across large parts of the country, however the increase did not benefit the grocery sector, according to Stats NZ.

10th November 2021 Environment / Stats NZ

10th November 2021 Environment / Stats NZGreenhouse gas emissions from agriculture, fishing, and forestry for the June 2021 quarter was flat at 9,069 kilotonnes, just 0.9% up on the same period last year.

14th October 2021 FPI / Stats NZ

14th October 2021 FPI / Stats NZSeasonally adjusted food prices were up 0.9% on the month prior in September as higher priced chicken and eggs came home to roost.

13th October 2021 Spend / Stats NZ

13th October 2021 Spend / Stats NZThe easing of Covid-19 alert levels everywhere apart from Auckland saw retail card spending edge up 0.9% or $45m compared with August to hit $5.15bn, according to Stats NZ.

25th August 2021 Sales / Stats NZ

25th August 2021 Sales / Stats NZFood and beverage services sales topped $3.38bn in June 2021 quarter, according to Stats NZ’s latest retail trade survey.

13th August 2021 FPI / Stats NZ

13th August 2021 FPI / Stats NZFood prices rose 1.3% in July compared with the previous month, mainly influenced by fruit and vege price hikes.

11th August 2021 Stats NZ

11th August 2021 Stats NZNew Zealanders spent $77m – or 0.9% – more using their credit and debit cards in July 2021 compared with the previous month, Stats NZ said today, with total card spending hitting $8.53bn.

13th July 2021 Prices / Stats NZ

13th July 2021 Prices / Stats NZCapsicum prices jumped 27% to a weighted average price of $24.16 per kilogram, an all-time high.

12th July 2021 Spend / Stats NZ

12th July 2021 Spend / Stats NZSupermarkets saw the biggest rise in Kiwi spending in June 2021 as wild weather drove people to stock up and stay indoors, according to Stats NZ.

28th June 2021 Exports / Stats NZ

28th June 2021 Exports / Stats NZMonthly goods exports were up $461m to $5.9bn after a 12% rise in dairy products in the month of May, according to StatsNZ.

16th June 2021 FPI / Stats NZ

16th June 2021 FPI / Stats NZFood price rose 0.4% in May compared with the month prior when rising prices for tomatoes and cucumbers contributed to a 1.1% jump, according to Stats NZ.

10th June 2021 Stats NZ

10th June 2021 Stats NZManufacturing sales volumes reached a record peak of $27bn in the March quarter, up 0.4% or $113m from the December 2020 quarter, according to Stats NZ.

3rd June 2021 Exports / Stats NZ

3rd June 2021 Exports / Stats NZTotal exports of goods and services fell $14.3bn or 16.5%, to $72.6bn in the year ending March 2021, as visibility of the full Covid-19 affected year emerged, according to Stats NZ.

27th May 2021 Stats NZ

27th May 2021 Stats NZIn April 2021, the value of total goods exports rose 1.2% or $65m compared with April 2020, to $5.4bn.

26th May 2021 Spend / Stats NZ

26th May 2021 Spend / Stats NZHigher retail spending on electronic items and outdoor recreational goods this summer helped boost overall spending in the March 2021 quarter, according to Stats NZ.

10th May 2021 Sheep / Stats NZ

10th May 2021 Sheep / Stats NZThe number of sheep in New Zealand in June 2020 was 26 million, down 3% on the same month in 2019, according to final agricultural production figures from Stats NZ.

16th April 2021 Stats NZ

16th April 2021 Stats NZFood prices were flat in March 2021, falling 0.4% compared to February 2021, according to Stats NZ.

14th April 2021 Spend / Stats NZ

14th April 2021 Spend / Stats NZSpending on grocery and liquor in March was down 3.3%, or $74m, from February 2021 levels, according to Stats NZ.

30th March 2021 Jobs / Stats NZ

30th March 2021 Jobs / Stats NZJobs in the accommodation and food services sectors were down 5.4% for February 2021.

19th March 2021 Exports / Stats NZ

19th March 2021 Exports / Stats NZGoods exports were up $233m in the December quarter, driven by an increase in fish, crustaceans, and molluscs, as well as milk powder, butter and cheese, according to Stats NZ.

12th March 2021 Stats NZ

12th March 2021 Stats NZRestaurant meals and foods such as Thai and Indian helped lift prices in Feb but it was the slowest growth for 18 months.

11th March 2021 Spend / Stats NZ

11th March 2021 Spend / Stats NZSpending on food fell in February 2021 due to Covid-19 restrictions, says Stats NZ.

10th March 2021 Manufacturing / Stats NZ

10th March 2021 Manufacturing / Stats NZDairy and meat product manufacturing fell 3.2% to $288m in the December 2020 quarter, says Stats NZ.

26th February 2021 Exports / Stats NZ

26th February 2021 Exports / Stats NZIt was the fifth consecutive month where dairy exports were less than the corresponding month a year ago.

18th December 2020 Stats NZ

18th December 2020 Stats NZStats NZ says NZ meat exporters were selling more for less.

14th December 2020 Prices / Stats NZ

14th December 2020 Prices / Stats NZAs air freight costs soared due to Covid-19 border closures, so did the price of exporting.

10th December 2020 Manufacturing / Stats NZ

10th December 2020 Manufacturing / Stats NZDairy and meat product manufacturing volumes, and wholesale grocery and liquor value saw huge lifts in the Sept quarter.

3rd December 2020 Stats NZ

3rd December 2020 Stats NZBoth dairy and meat exports have taken a dive in the September quarter.

27th November 2020 Stats NZ

27th November 2020 Stats NZSome dairy products were down $198m.

24th November 2020 Stats NZ

24th November 2020 Stats NZNZ’s retail sector is on the road to recovery, according to the latest figures from Stats NZ.

19th November 2020 Stats NZ

19th November 2020 Stats NZGains made in the March and June quarters have been impacted by the fall.

30th October 2020 Stats NZ

30th October 2020 Stats NZThey’ve increased by 58% in over two decades.

© 2024 Business Media Network Ltd

Website by Webstudio