19th March 2024 M&A / PwC

19th March 2024 M&A / PwCLast year was a low point for merger and acquisition activity, but receding recession fears mean the pace is likely to pick up in 2024.

23rd February 2024 Comvita / M&A

23rd February 2024 Comvita / M&AComvita calls in a team of advisers after an unnamed overseas party made a non-binding takeover offer at a “significant premium” to the firm’s current share price.

21st February 2024 M&A / MHM

21st February 2024 M&A / MHMListed food industry supplier MHM Automation intends to delist from the NZX following its proposed $151.4m sale to US-based Bettcher Industries.

15th December 2023 Investment / M&A

15th December 2023 Investment / M&AAcquisition activity is set to end the year with a whimper in terms of deal volume, with some high-profile deals likely to slip into 2024 as investors bide their time.

15th December 2023 M&A / Nui Markets

15th December 2023 M&A / Nui MarketsNew Zealand-owned and operated global digital trading platform for agricultural products, Nui Markets, is buying an Australian company to help its expansion in to the US.

22nd November 2023 Ebos / M&A

22nd November 2023 Ebos / M&AEbos Group is no longer in talks over a potential purchase of Australian vet and pet group Greencross.

16th November 2023 Ebos / M&A

16th November 2023 Ebos / M&ADual-listed Ebos Group is in NZX and ASX trading halts following it being linked to the purchase of TPG Capital-backed pet and vet group Greencross.

15th November 2023 M&A / PwC

15th November 2023 M&A / PwCFood and beverage deals help lift overall activity to be “better than expected” for the period.

14th November 2023 M&A / Sealord

14th November 2023 M&A / SealordComCom says the deal, which turns Sealord into NZ’s largest seafood company, is unlikely to substantially lessen competition.

13th November 2023 M&A / Scott Technology

13th November 2023 M&A / Scott TechnologyScott Technology’s ownership structure is staying as is – for the time being.

1st November 2023 Cloudy Bay / M&A

1st November 2023 Cloudy Bay / M&AWine company Cloudy Bay is adding to its Marlborough landholdings, with the proposed purchase of a vineyard and land in the region.

1st November 2023 GSH / M&A

1st November 2023 GSH / M&AGood Spirits Hospitality is going ahead with a payout of $600k to its shareholders related to its asset sale, despite it being technically voted down via a conditional resolution last week.

20th September 2023 M&A / Pernod Ricard

20th September 2023 M&A / Pernod RicardGlobal drinks company Pernod Ricard is revisiting a potential sale of its Australian and New Zealand wine brands – a divestment it explored in 2019.

15th September 2023 M&A / Sealord

15th September 2023 M&A / SealordAn acquisition of the Christchurch-based fishing business would make Sealord the country’s biggest seafood business.

12th September 2023 M&A / Mainland Poultry

12th September 2023 M&A / Mainland PoultryMajority owners Navis Capital is reviewing its ownership of the egg producer, which could result in a $400m-plus sale.

15th August 2023 M&A / PwC

15th August 2023 M&A / PwCDeal activity remained on an even keel in Q2 but headwinds could see more consolidation in sectors such as food manufacturing and hospitality.

2nd August 2023 GSH / M&A

2nd August 2023 GSH / M&AGood Spirits Hospitality’s Geoff Tuttle and Nourish Group founder Richard Sigley are part of the group buying the nine-strong portfolio.

11th July 2023 Agritech / M&A

11th July 2023 Agritech / M&ADairy farm reporting software company Trev has acquired red meat specialist Cloud Farmer, a pioneer of farm recording in New Zealand.

7th July 2023 Inghams / M&A

7th July 2023 Inghams / M&AAustralasian poultry group Inghams has been given the green-light by the Commerce Commission for the upstream acquisition.

5th July 2023 GSH / M&A

5th July 2023 GSH / M&AGood Spirits Hospitality has received final bids as part of the sales process for its nine-strong portfolio of venues.

4th July 2023 Comvita / M&A

4th July 2023 Comvita / M&AComvita makes good on its pledge to consolidate ownership of the mānuka honey sector, buying Singapore’s HoneyWorld.

28th June 2023 M&A / Service Foods

28th June 2023 M&A / Service FoodsThe acquisitive foodservice company continues to expand, this time picking up a Tegel subsidiary in Wellington.

21st June 2023 GSH / M&A

21st June 2023 GSH / M&AGood Spirits Hospitality is expecting final bids shortly as part of the sales process for its nine-strong portfolio.

2nd June 2023 M&A / Synlait

2nd June 2023 M&A / SynlaitThe decision to divest the consumer cheese businesses comes four years after investing around $150m to acquire them.

17th May 2023 GSH / M&A

17th May 2023 GSH / M&AThe under pressure Auckland hospitality group reports “good interest” from potential buyers as the sales process for its nine-strong portfolio grinds on.

3rd May 2023 GSH / M&A

3rd May 2023 GSH / M&ALenders to Good Spirits Hospitality have once again deferred a March quarter interest payment, as it pursues a sale of the business.

1st May 2023 DB / M&A

1st May 2023 DB / M&ADB Breweries has completed a deal which creates what it says is the largest hospitality group in the country, Star Hospitality.

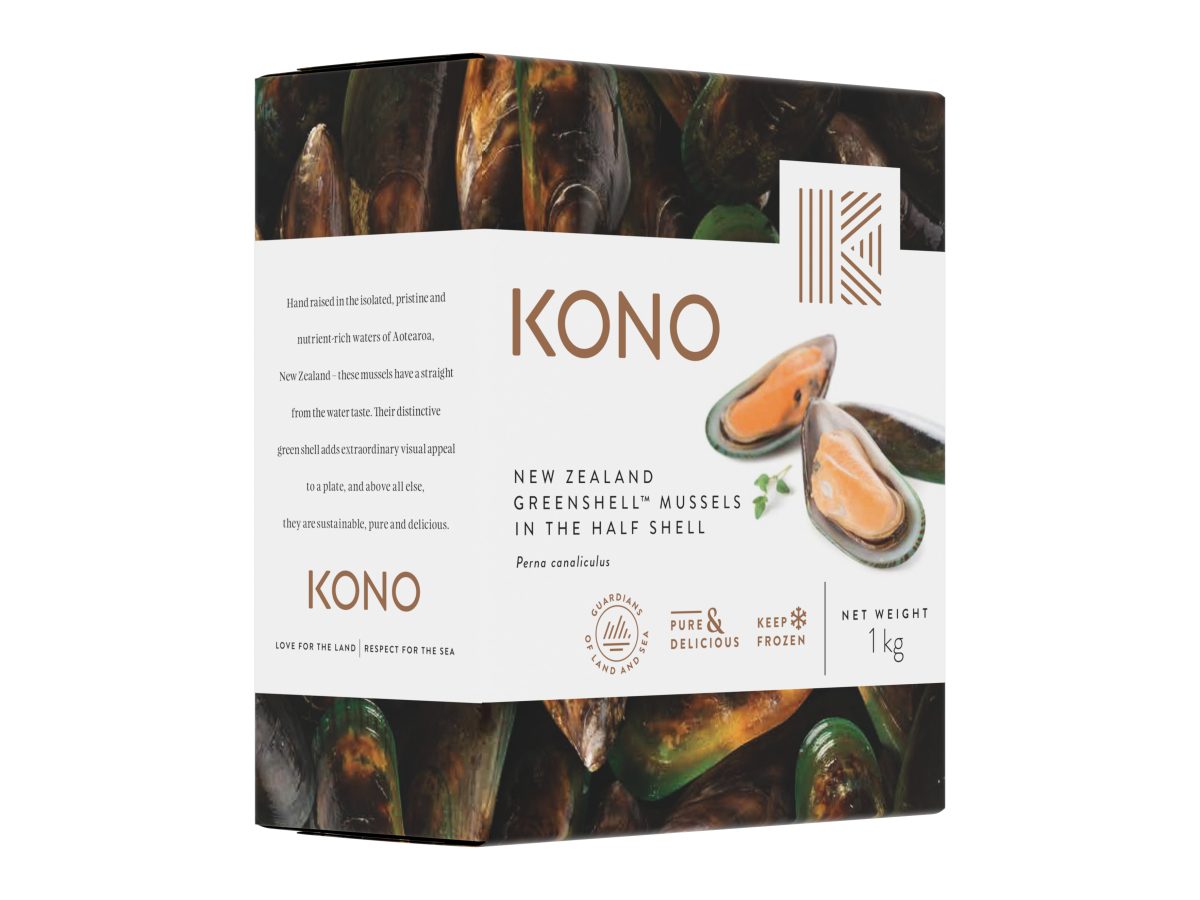

19th April 2023 Annies / M&A

19th April 2023 Annies / M&AGraeme and Annie Giles have retaken control of the brand, which was destined to disappear after being shut down by Kono.

7th March 2023 M&A / Trust Codes

7th March 2023 M&A / Trust CodesThe firm is snapped up by acquisitive international logistics management company VerifyMe, providing the Kiwi business with a springboard into the US.

2nd March 2023 M&A / NZCS

2nd March 2023 M&A / NZCSNew Zealand Coastal Seafoods has completed the acquisition of Australian seafood fishing and wholesale export business, Nine Ocean, via a share purchase deal.

23rd February 2023 Fonterra / M&A

23rd February 2023 Fonterra / M&AFonterra is progressing its condition sales of its Chilean Soprole business to Gloria Foods, having received sign-off from the country’s competition authority.

22nd February 2023 M&A / PwC

22nd February 2023 M&A / PwCThe scene is set for a cool down in merger and acquisition activity following two years of peak deals fuelled by cheap money and a strong economy, according to PwC.

15th February 2023 M&A / Subway

15th February 2023 M&A / SubwayThe Connecticut-headquartered company has enlisted investment bank JP Morgan to explore a sales process for the company, which could fetch an estimated US$10bn.

7th February 2023 Hospitality / M&A

7th February 2023 Hospitality / M&AAn Australian private equity firm and owner of sausage maker Hellers is buying the company which owns Boost Juice and Betty’s Burgers.

14th December 2022 Investment / M&A

14th December 2022 Investment / M&AA flurry of F&B-related takeovers completed in the final quarter of 2022, closing out a solid year for NZ food industry mergers and acquisitions.

13th December 2022 M&A / SeaDragon

13th December 2022 M&A / SeaDragonThe consortium of investors buying out SeaDragon’s minority shareholders has confirmed it now has control of “90% or more” of the voting rights in the fish oil refining company.

30th November 2022 M&A / Service Foods

30th November 2022 M&A / Service FoodsThe foodservice distributor completed the deal in just seven days with a specific asset and growth potential catching its eye.

25th November 2022 M&A / Service Foods

25th November 2022 M&A / Service FoodsThe acquisitive foodservice distributor adds another butcher and its retail brand to its growing portfolio.

2nd November 2022 M&A / OIO

2nd November 2022 M&A / OIOA new majority owner for Waiheke Island’s Stonyridge Vineyard has plans for export growth.

1st November 2022 M&A / Wine

1st November 2022 M&A / WineInternational wine heavyweight Edmond de Rothschild Heritage paid $10m to buy Akarua in Central Otago from local rich-listers the Skeggs family.

28th October 2022 GSH / M&A

28th October 2022 GSH / M&AGood Spirits Hospitality has appointed Tonnant Partners as its transaction advisor.

21st October 2022 M&A / Yealands

21st October 2022 M&A / YealandsA deal for Yealands will follow two other separate industry transactions underway for New Zealand wine businesses.

11th October 2022 M&A / NZCS

11th October 2022 M&A / NZCSChristchurch-based NZCS says it is a “unique opportunity” to establish an Australian base.

20th September 2022 M&A / Move Logistics

20th September 2022 M&A / Move LogisticsMove Logistics Group has walked away from its proposed $15.2m acquisition of domestic bulk liquids and dry powder transport provider Fluidex.

16th September 2022 Leader / M&A

16th September 2022 Leader / M&A“We are excited about this unique opportunity to take some of Australia and NZ’s best-loved brands to the next level,” says the Hong Kong-based investor, one of Asia’s largest PE firms.

6th September 2022 M&A / Prolife Foods

6th September 2022 M&A / Prolife FoodsAmong the big opportunities from the new partnership could be a push in Europe for the Waikato company’s mānuka honey brand Haddrell’s.

2nd September 2022 M&A / Ziwi

2nd September 2022 M&A / ZiwiThe private equity-owned pet food company is adding the largest freeze-drying operation in the

Southern Hemisphere to its operations.

24th August 2022 M&A / Move Logistics

24th August 2022 M&A / Move LogisticsMove Logistics Group has signed a $15.2m agreement to acquire the business and assets of Fluidex Transport, a domestic bulk liquids and bulk dry powder transport provider with recurring revenue of $11m.

16th August 2022 Just Life / M&A

16th August 2022 Just Life / M&ATony Falkenstein’s Just Life Group is adding Natural Solutions NZ to its ‘Healthy Living’ division, following its purchase of About Health and Intenza New Zealand.

22nd July 2022 M&A / Subscriber Content

22nd July 2022 M&A / Subscriber Content“When the Good Spirits Hospitality deal did not proceed, it was felt that there was a significant amount of synergy with other Foley investments in New Zealand,” says Foley CEO Mark Turnbull.

30th June 2022 M&A / NZKS

30th June 2022 M&A / NZKSThe salmon business says it has not been approached, nor is in discussions with any parties following a report it is gauging interest.

28th June 2022 IRI / M&A

28th June 2022 IRI / M&ANZ could see a wave of F&B acquisitions as rising costs pile pressure on smaller manufacturers.

31st May 2022 Comvita / M&A

31st May 2022 Comvita / M&AComvita has scotched reports that it is in talks over a proposed take-private by shareholder CR Capital Management, the investment arm of Chine Resources Holdings Co.

18th May 2022 M&A / NZCS

18th May 2022 M&A / NZCSThe seafood supplement specialist has booked a strong start to the year with revenue jumping 242% from the same quarter in 2021.

18th May 2022 M&A / PwC

18th May 2022 M&A / PwCThere were 45 M&A deals announced or completed in the first three months of the year, according to PwC’s latest quarterly update, compared with just 11 for the same period last year.

7th May 2021 Arnott's / M&A

7th May 2021 Arnott's / M&AThe deal catapults Australian biscuit giant Arnott’s into NZ’s premium cracker category.

© 2024 Business Media Network Ltd

Website by Webstudio