20th July 2022 By Contributor | contact@foodticker.co.nz | @foodtickernz

The grocery industry has been transformed by the pandemic and omnichannel is now the rule rather than the exception, with those delivering an optimised experience across both digital and physical aisles winning in 2023, writes research company NielsenIQ.

Consumer goods categories have seen a seismic shift in channel growth, with online sales significantly outpacing in-store growth.

As more pre-pandemic activities resume and more consumers feel comfortable going out, many businesses are left scrambling to anticipate what the “new normal” will be as they plan for 2023.

Companies that can deliver an optimised experience across both digital and physical aisles will be the winners in the future of CPG.

New buying patterns emerge

The path to purchase has become exponentially more complicated: the rise of omnichannel has opened entirely new worlds to businesses that must be managed through an omni lens. For example, alongside curbside and “click and collect” buying patterns, NielsenIQ has uncovered a new buying pattern: Click + Collect + Complete. More than one in five (22%) of shoppers plan an in-store shopping trip combined with a prior online order.

As businesses plan and budget for 2023, the question remains, “How do we figure out what to expect?” Consumers’ needs, priorities, and shopping habits have radically transformed and continue to change. Past forecasting and measurement methods can fall short, leading to expensive inventory surpluses or shortages.

CPG businesses must plan with an omnichannel mindset to stay relevant, measure behaviour in a way that allows them to anticipate future changes and capitalize on emerging trends. Omnichannel insights illuminate the “why” behind consumer behaviour, empowering businesses to answer crucial strategic questions such as:

Omnichannel shopping maintains dominance

Omnichannel is the rule rather than the exception: 91% of FMCG dollar sales are represented by omnishoppers. Consumers who purchase goods both in-store and online comprise 86% of shoppers, with just 14% of buyers shopping exclusively in-store. Less than 1% of consumers shop exclusively online. Far from being a passing trend, omnichannel is a permanent – and substantial – fixture of consumer behaviour.

With the industry already experiencing massive transformation, shoppers are anticipating even more changes to their spending decisions. Globally, 30% of consumers indicated that they now have a completely different set of priorities that impact their purchase behaviour, and 59% are re-evaluating their priorities. In the US, 81% of consumers are re-evaluating their priorities or already have different priorities.

Welcome news for CPG companies is that Americans intend to spend more on groceries, according to NielsenIQ’s Consumer Outlook 2022 survey. US consumers also plan to spend more on in-home entertainment, food delivery and home improvements.

Case Study: Finding the cause of shampoo blues

Let’s look at an example of omnichannel insights in action with a use case, through the lens of a brand manager searching for the underlying cause of one product’s low performance.

The manufacturer of a shampoo brand, Brand A, identified a problem: they were losing sales and market share. They began investigating potential causes, asking a series of questions to uncover irregularities and prioritize the biggest areas of concern:

Are our online sales incremental? A NielsenIQ incrementality report showed that market expansion was significant compared to the category, so it was safe to conclude that the growth was likely incremental.

How does the buying behaviour differ online versus in-store? Comparing Brand A’s performance to category performance revealed a significant difference that prompted further investigation. Although 20% of shampoo shoppers bought online, just 8% of Brand A’s shoppers were. Was there an issue with buyers of the brand not converting online?

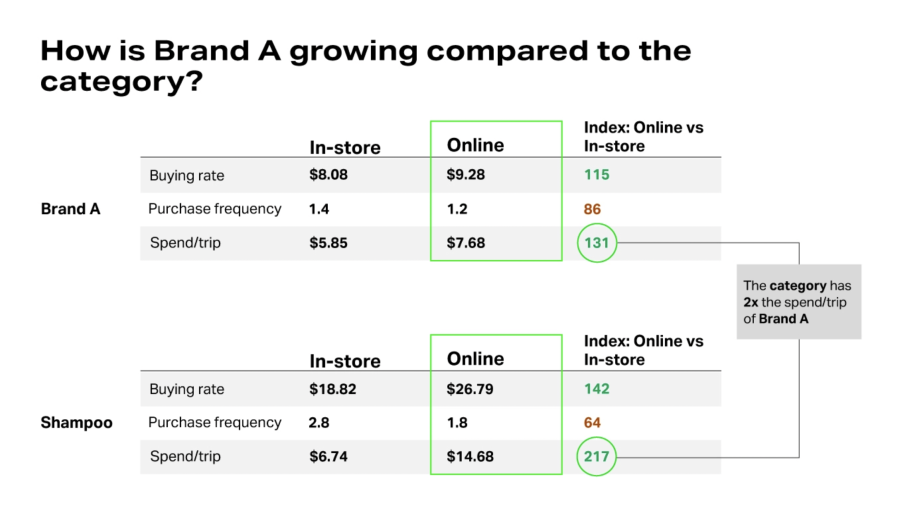

To take a deeper dive into the behaviour of their online buyers, Brand A examined online purchase frequency and pricing data, two of the biggest triggers from an online standpoint. The shampoo category had almost double the spend rate of Brand A. The purchase frequency for the category had also significantly decreased. These changes aligned with the broader trend of larger pack sizes and multi-packs being offered, and Brand A’s lagging numbers warranted further investigation.

Are customers leaking to competitors? A review of omnichannel consumer panel data showed that Brand A’s performance was just half a percent below category performance, so leakage to competitors was not a significant or urgent problem to address. The manufacturer’s investment of time and resources would be better allocated elsewhere.

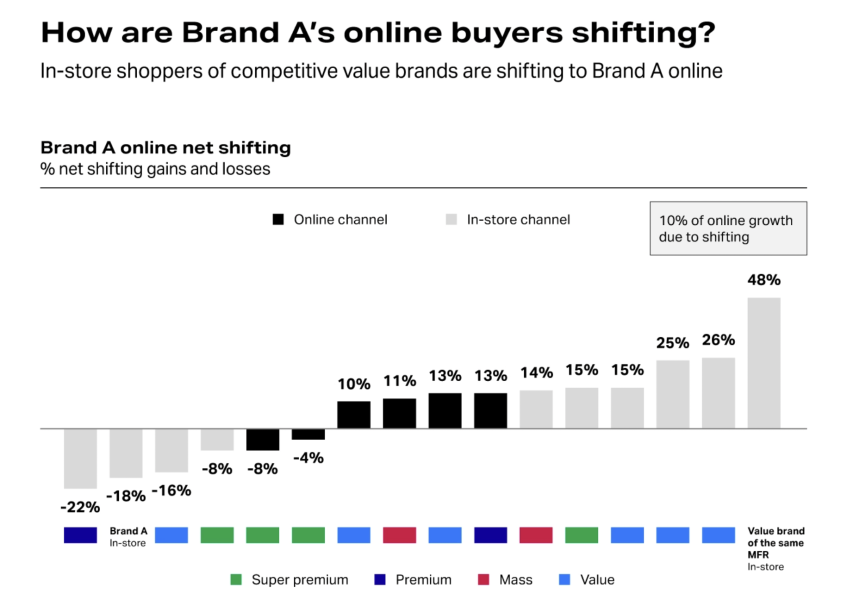

How are my buyers shifting from in-store to online? Omnishopper data showed there had been gains in mass and value brands, but the largest gains by far had come from another brand the manufacturer owned. If it had been part of the manufacturer’s promotion strategy to upgrade shoppers to a higher-tier brand, they succeeded. However, if the push was unintentional, then the manufacturer had inadvertently cannibalised its own products.

What are the demographics of my buyers online versus in-store? Some manufacturers believe that they cannot compete in pure play online or mass retailer dot coms. But a demographic study can help brands determine whether they can perform well in this channel. Omnishopper data showed that Brand A was likely to hold its own.

What are the emerging trends in our category? The manufacturer also examined which individual attributes drove online purchases, discovering that Brand A was missing from over 160,000 customer searches because it was only claiming one of the top seven most-searched attributes, “Repairing/healing.”

It was estimated that Brand A’s missing (but claimable) attributes resulted in 945 million missed impressions. Assuming a conversion rate of 12% and a unit price of US$4.85, this resulted in an estimated US$550m in missed revenue. Even a conversion rate of 6% would indicate missed revenue of US$275m – revenue easy to capture by pulling a few simple levers.

While many external and internal factors influence each brand’s decision around which attributes to emphasize, omnichannel insights like these help them make informed decisions that best align with their goals, strategy, and desired outcomes.

Finding your footing in a shifting landscape

The omnichannel landscape is increasingly difficult to navigate, with a bevy of challenges standing between CPG companies and consumers’ new expectations. Succeeding in this evolving environment requires using tools built to measure omnishopper behavior, providing a comprehensive view of customers across in-store and online channels for a deeper understanding.

First published by NielsonIQ on nielsoniq.com, read the original article here.

27 Feb 2024 Perspectives: Researchers looked at 700 plant-based foods – so how ‘healthy’ are they really?

15 Feb 2024 Perspectives: The rise of robo-retail – who gets left behind when shopping is automated?

12 Feb 2024 Perspectives: How to maximise the impact of cellular agri for sustainable food production

© 2024 Business Media Network Ltd

Website by Webstudio